Rethinking Tobacco Taxation in Pakistan: A Call for Immediate Reforms

Introduction

The Framework Convention on Tobacco Control[i] (FCTC) aims to mitigate the adverse impacts of tobacco consumption. Tobacco taxation, a key FCTC measure, remains underutilized in several low and middle-income countries including Pakistan. The lack of a proper policy has resulted in a weak tobacco taxation structure even after two decades of FCTC adoption. Most of the taxes on the tobacco sector are imposed through the yearly budget, completely depending upon the will of the government in office.

Background/Context

Tobacco taxation is considered the most effective measure which serves a dual objective of public health promotion and revenue generation. Pakistan lacks a clear strategy on tobacco taxation and Federal Excise Duty (FED) remains a major tax levied on cigarettes. The FED structure has frequently been manipulated by powerful businesses to suit and safeguard their interests, often at the expense of public health considerations. In one such instance, a three-tier system was introduced in 2017 to control illicit trade but the move paradoxically led to ‘illicit profiteering’ for cigarette companies.

Loss and Industry Influence

A study[ii] on tobacco taxation, based on data from the Federal Board of Revenue (FBR) yearbooks and reports, exposes a staggering Rs 567 billion revenue loss during the past seven years. The cigarette companies’ deceptive tactics, manipulating tax structures under the pretext of controlling illicit trade, contributed to this significant economic setback. Multinational companies persuaded the government to introduce a third tier, exaggerating numbers related to illicit trade, ultimately benefiting from reduced taxes and increasing their profits. These companies propagated that the share of illicit and non-duty-paid cigarettes in the country is over 40% in the country.

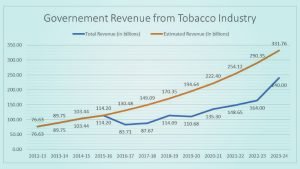

Figure 1: Source FBR data

The World Bank[iii] reported that several country cases testified that the cigarette industry used exaggerated estimates of illicit trade to argue against tobacco tax increases. It noted that the changes in the excise rate on cigarettes boosted sales. The size of the illicit sector “is not as large as the one claimed by the cigarette companies. The research conducted by the Pakistan National Hearts Association (Panah) revealed that the illicit cigarette trade is less than 9% in Pakistan[iv].

Government’s Approach

The government’s decision to introduce a three-tier excise duty under the influence of the industry in 2017 proves that the government policies when it comes to the cigarette industry, lack independence. The motive behind the move was cited to target the illicit tobacco trade. However, the move not only failed to achieve its intended purpose but also resulted in substantial revenue loss and increased tobacco consumption.

Figure 2: Source FBR data

The National Accountability Bureau (NAB) initiated an inquiry in 2018 into Rs33 billion[v] worth of tax benefits obtained by two major multinational cigarette manufacturing companies through the change in the tax tier structure.

The Auditor General of Pakistan contradicted[vi] the Federal Board of Revenue’s (FBR) viewpoint regarding benefits accrued from the introduction of the third tier.

It would be pertinent to mention that the authorities missed all targets of revenue collection during the past seven years.[vii]

Policy Recommendations

- Safeguarding from Industry Interference: Strengthen policy development by safeguarding against industry influence, aligning with FCTC guidelines and addressing the loopholes[viii]

- Public Health-Centric Approach: Prioritize public health over industry interests, recognizing the health and economic burden of tobacco consumption.

- Enforcement: To effectively combat the illicit tobacco trade, a focused enforcement policy entailing penalties is needed. Regular evaluations and adaptations of enforcement strategies will be crucial for sustained efficacy, demonstrating a commitment to prioritize and intensify efforts against illicit tobacco activities.

- Uniform tax rate: According to WHO uniform tax[ix] leads to larger reductions in smoking as there is less opportunity to switch between different tiers and types of tobacco products.

- Long-term policy: There is an urgent need to develop a long-term tobacco taxation policy in Pakistan. The policy should be aligned to Article 6 of FCTC (Price and tax measures to reduce the demand for tobacco), WHO’s Manual on Tax Administration – 2021, Ministry of Health’s National Tobacco Control Strategy-2023, 12th Five Years Plan 2018-23, National Health Vision 2016-25, and Action Plan NHSR&C 2019-23.

Implementation Strategy

Enforce stringent measures to prevent the cigarette industry’s interference, considering recommendations from global health organizations. A recent study has proved that the consumption of cigarettes in Pakistan has decreased after the imposition of high taxes by the government[x].

Conclusion

The study reveals a substantial Rs 567 billion loss in the past seven years, emphasizing the urgent need for policy reforms. To safeguard public health and optimize revenue streams, Pakistan should revert to effective taxation models, uphold FCTC principles, and prioritize the well-being of its population.

[highlight txtcolor=”#dd8500″]References[/highlight]

[i] https://fctc.who.int/publications/m/item/price-and-tax-measures-to-reduce-the-demand-for-tobacco

[ii] https://sdpi.org/tobacco-taxation-in-pakistan-unravelling-the-revenue-loss-of-rs-567b-to-exchequer/publication_detail

[iii] https://documents1.worldbank.org/curated/en/498131560807146415/pdf/Pakistan-Overview-of-Tobacco-Use-Tobacco-Control-Legislation-and-Taxation.pdf

[iv] https://www.dawn.com/news/1399630

[v] https://www.dawn.com/news/1410809

[vi] https://senate.gov.pk/uploads/documents/1552287245_370.pdf

[vii] https://www.thenews.com.pk/print/1147313-govt-fails-to-meet-tax-target-from-cigarette-industry-study

[viii] https://www.dawn.com/news/1812458/call-to-plug-tax-loopholes-to-save-billions

[ix] https://applications.emro.who.int/docs/WHOEMTFI218E-eng.pdf?ua=1

[x] https://thefridaytimes.com/16-Feb-2024/higher-tax-on-cigarettes-results-in-lower-consumption

Leave a Reply